Medicare Part B

Essential Highlights

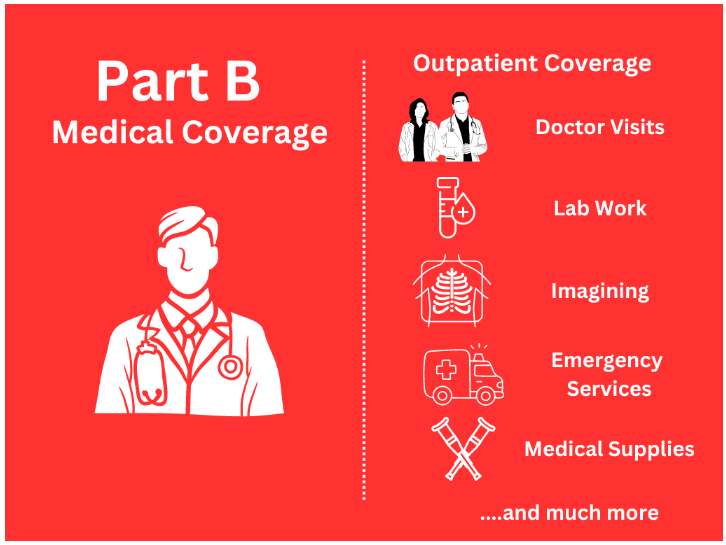

In general, Medicare Part B covers a wide range of medically necessary outpatient services.

Medicare Part B

You might be feeling a bit overwhelmed by all the Medicare talk. Don’t worry; you’re not alone. Medicare can seem like a maze, especially if you’re new to it. Let’s break down Medicare Part B in a way that’s easy to understand.

What is Medicare Part B?

Medicare Part B is a part of the federal health insurance program known as Medicare. It’s designed to cover medical services and supplies that are necessary to treat your health condition. While Medicare Part A covers hospital stays, Part B focuses on outpatient care.

Difference Between Medicare Part A and Part B

Think of Medicare Part A as your hospital insurance – it covers things like inpatient hospital stays, skilled nursing facility care, and some home health care. On the other hand, Medicare Part B is your medical insurance. It covers doctor visits, preventive services, outpatient care, and some home health services. Together, they form a comprehensive health care plan.

Who is Eligible for Medicare Part B?

Most people become eligible for Medicare Part B when they turn 65. If you’re already receiving Social Security benefits, you’ll be automatically enrolled. If not, you may need to sign up during your Initial Enrollment Period (IEP), which starts three months before your 65th birthday and ends three months after your birthday month.

Enrollment in Medicare Part B

When to Enroll

- Initial Enrollment Period (IEP): This is the best time to enroll to avoid late penalties. It spans seven months around your 65th birthday.

- Special Enrollment Period (SEP): If you’re still working and have employer coverage, you can enroll in Medicare Part B without a penalty when your employment or coverage ends.

- General Enrollment Period (GEP): If you miss your IEP, you can enroll between January 1 and March 31 each year, but you might face a late enrollment penalty.

How to Enroll

Enrolling in Medicare Part B is straightforward. If you’re not automatically enrolled, you can sign up online through the Social Security Administration’s website, call them, or visit your local Social Security office. You’ll need some basic information, like your Social Security number and birth certificate.

Consequences of Late Enrollment

Enrolling late can lead to higher premiums. For every 12-month period you were eligible but didn’t sign up, your premium may increase by 10%. This penalty lasts for as long as you have Medicare Part B, so it’s best to enroll on time.

Costs Associated with Medicare Part B

Understanding the costs can help you budget for your healthcare needs.

Premiums

Most people pay a standard monthly premium for Medicare Part B. In 2024, the standard premium is $174.70, but it can be higher depending on your income.

Deductibles and Coinsurance

-

Annual Deductible: In 2024, the deductible is $240. This means you pay the first $240 of your medical costs each year.

-

Coinsurance: After meeting your deductible, you typically pay 20% of the Medicare-approved amount for services.

What Services Are Covered

- Doctor Visits: This includes visits to your primary care physician and specialists.

- Preventive Services: Things like screenings, vaccinations, and annual wellness visits. For example, getting your flu shot is covered.

- Outpatient Care: This includes emergency room visits, outpatient surgery, and diagnostic tests like X-rays and MRIs.

- Home Health Services: If you’re homebound, Part B covers services like physical therapy or skilled nursing care.

- Durable Medical Equipment (DME): Equipment like wheelchairs, walkers, and oxygen equipment.

What Services Are Not Covered

Medicare Part B does not cover everything. Routine dental care, vision exams, hearing aids, and long-term care are not included. You might need additional insurance for these services.

Cost-Saving Programs

- Medicare Savings Programs (MSPs): These can help pay for your Part B premiums, deductibles, and coinsurance. Eligibility is based on income and resources.

- Extra Help: This program helps with prescription drug costs if you have limited income and resources.

How to Use Medicare Part B

Once you’re enrolled, knowing how to use your benefits effectively is important.

Choosing Healthcare Providers

You can see any doctor or specialist that accepts Medicare. It’s important to understand the difference between participating and non-participating providers.

- Participating Providers: These providers accept Medicare’s approved amount as full payment.

- Non-Participating Providers: These providers can charge up to 15% more than Medicare’s approved amount. These are called Excess charges.

Filing Claims

Usually, your doctor or healthcare provider will file claims for you. You’ll receive a Medicare Summary Notice (MSN) every three months detailing what services were billed and what Medicare paid. Always review your MSN for accuracy.

Tips for Maximizing Benefits

- Preventive Services: Take advantage of free preventive services to stay healthy.

- Ask Questions: Don’t hesitate to ask your doctor if a service or test is necessary and if it’s covered by Medicare.

- Keep Records: Maintain a personal health record of your visits, tests, and procedures.

Coordination with Other Insurance

Many people have other insurance in addition to Medicare. Understanding how Medicare works with other insurance can save you money.

Coordination of Benefits (COB)

Medicare might not always be your primary payer. Here’s how it works:

- Employer Insurance: If you’re still working and have employer coverage, your employer’s plan pays first, and Medicare pays second.

- Medigap: These plans, also known as Medicare Supplement Insurance, help cover out-of-pocket costs like coinsurance and deductibles.

- Medicaid: If you qualify, Medicaid can help pay for costs not covered by Medicare.

Primary vs. Secondary Payer

Understanding who pays first is crucial. For example, if you have retiree insurance from a former employer, Medicare Part B typically pays first, and your retiree plan pays second.

Common Questions and Concerns

Frequently Asked Questions

- What if I miss my enrollment period? You can enroll during the General Enrollment Period, but you might face penalties.

- How can I lower my costs? Look into Medicare Savings Programs and Extra Help if you have limited income.

- What services require prior authorization? Some services, like durable medical equipment, might need approval in advance.

Common Misconceptions

- “Medicare covers everything.” Not true. There are gaps, and understanding them helps you avoid surprises.

- “I don’t need Part B if I’m healthy.” If someone doesn’t sign up for Part B when they are first eligible and don’t qualify for a Special Enrollment Period, they may have to pay a late enrollment penalty for as long as they have Part B.

Conclusion

Medicare Part B is a critical part of your healthcare coverage, and understanding it can help you make the best decisions for your health and finances. Don’t hesitate to seek personalized advice and review your individual situation. Remember, understanding Medicare Part B might take some time, but with the right resources and a bit of patience, you can navigate it successfully. Feel free to reach out with any questions.