Medigap Plan F

Essential Highlights

Medicare Supplement Plan F stands out as the most extensive option among Medicare Supplement plans, offering coverage for all gaps in Medicare.

Effective January 1, 2020, Plan F was discontinued for individuals who qualified for Medicare benefits.

The cost of Plan F’s monthly premium is determined by factors such as geographic location, age, gender, and tobacco usage.

Medigap Plan F

Navigating Medicare can be a daunting task, especially if you’re new to the world of insurance. Terms like Medigap and Plan F might seem confusing. As an experienced insurance representative, We’ve guided many seniors through their Medicare options. Regarding Medigap Plan F we will cover what it is, its benefits, and why it’s no longer available to new enrollees. By the end, you’ll have a solid understanding of Medigap Plan F and how it fits into your healthcare plan.

What Are Medigap Plans?

Let’s start with the basics. Medigap, or Medicare Supplement Insurance, is designed to fill the gaps in Original Medicare (Parts A and B). These gaps include out-of-pocket costs like deductibles, copayments, and coinsurance. Medigap plans are offered by private insurance companies and are standardized, meaning the benefits of each plan are the same regardless of the insurer.

Overview of Medigap Plan F

Comprehensive Coverage

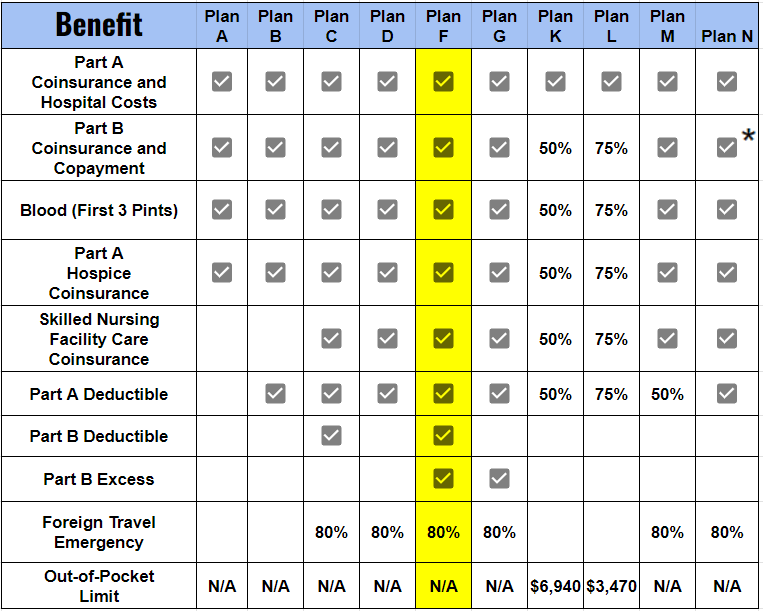

Medigap Plan F is known for its comprehensive coverage. It’s considered the “Cadillac” of Medigap plans because it covers almost all out-of-pocket costs that Medicare Parts A and B don’t cover. Here’s a rundown of what Medigap Plan F covers:

- Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up

- Part B coinsurance or copayments

- The first three pints of blood

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B deductible

- Part B excess charges

- Foreign travel emergency (up to plan limits)

✓ = 100% coverage

✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted)

Eligibility and Enrollment

Who Is Eligible for Medigap Plan F?

Medigap Plan F is available to those who were eligible for Medicare before January 1, 2020. Unfortunately, if you became eligible for Medicare on or after that date, you won’t be able to enroll in Medigap Plan F. This change is due to the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, which phased out Plans F and C for new enrollees to reduce costs to the Medicare program.

Costs of Medigap Plan F

Monthly Premiums

The cost of Medigap Plan F varies based on several factors, including your age, location, gender, and tobacco use. Generally, Medigap Plan F has higher premiums compared to other Medigap plans due to its comprehensive coverage. However, many seniors find the higher premium worth the peace of mind it provides.

Out-of-Pocket Costs Covered by Medigap Plan F

One of the biggest advantages of Medigap Plan F is that it covers nearly all out-of-pocket costs. This means you won’t have to pay deductibles, copayments, or coinsurance for covered services. For seniors on a fixed income, this predictability in healthcare costs is invaluable.

Comparing Medigap Plan F with Other Plans

Differences from Other Medigap Plans

While Medigap Plan F offers the most comprehensive coverage, other Medigap plans like Plan G and Plan N also provide substantial benefits. The key difference between Medigap PlMedigap Plan F: A Comprehensive Guide for Seniorsan F and Plan G is that Plan G does not cover the Part B deductible. However, the premiums for Plan G are often lower than those for Medigap Plan F, which can make it a more cost-effective option for some seniors.

Pros and Cons of Choosing Medigap Plan F

Pros:

- Comprehensive coverage with no out-of-pocket costs for covered services

- Peace of mind knowing all gaps in Original Medicare are covered

Cons:

- Higher premiums compared to other Medigap plans

- Not available to new Medicare beneficiaries after January 1, 2020

How to Choose the Right Medigap Plan

Choosing the right Medigap plan depends on your individual health needs, budget, and future medical expenses. Here are some factors to consider:

Health Needs

If you have frequent medical appointments or chronic conditions, a plan like Medigap Plan F that offers comprehensive coverage might be the best fit for you. However, if you’re generally healthy and don’t anticipate high medical costs, a plan with lower premiums and fewer benefits might be sufficient.

Budget

Consider your monthly budget and how much you can afford in premiums. While Medigap Plan F offers extensive coverage, its higher premiums may not be feasible for everyone. Comparing the costs and benefits of different plans can help you find a balance that works for you.

Conclusion

Medigap Plan F has been a popular choice for seniors due to its comprehensive coverage and the peace of mind it offers. Although it’s no longer available to new Medicare beneficiaries, those who were eligible for Medicare before January 1, 2020, can still enroll and enjoy its benefits. When choosing a Medigap plan, it’s important to consider your health needs, budget, and future medical expenses. Consulting with an experienced insurance representative at 411Medicare can help you make an informed decision that best suits your needs.