Medigap Plan L

Essential Highlights

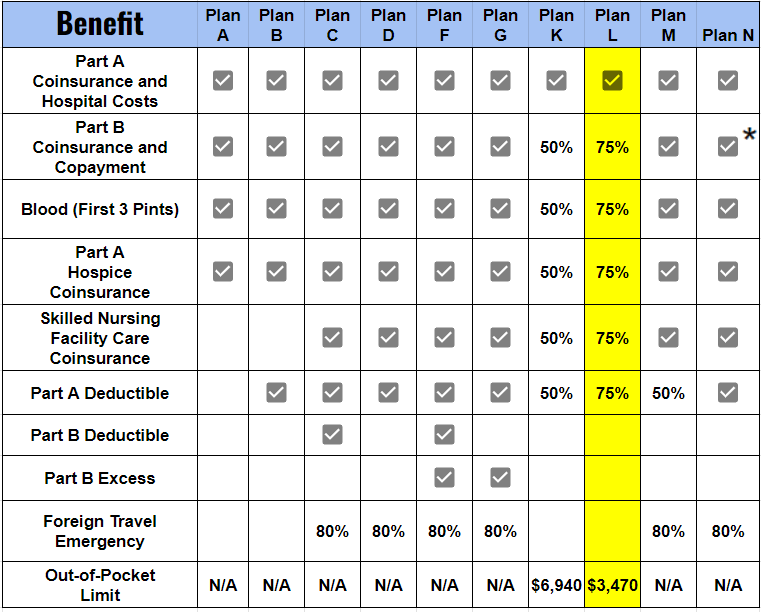

Medigap Plan L is among the ten standardized Medigap plans available.

Plan L covers 75% of the cost of Medicare benefits after the amount that Medicare pays.

Plan L has a maximum out-of-pocket limit due to higher out-of-pocket costs.

What is Medigap Plan L?

An Introduction to Medigap

Before we delve into Medigap Plan L, let’s quickly touch on what Medigap is. Medigap, also known as Medicare Supplement Insurance, helps fill “gaps” in Original Medicare. It’s designed to help pay some of the healthcare costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

Medigap Plan L: The Basics

Medigap Plan L is one of the ten standardized Medigap plans available in most states. Each plan offers a different combination of benefits, and Medigap Plan L is known for its balance between coverage and cost. It’s a popular choice for those who want some level of coverage without paying the higher premiums associated with other plans.

What Does Medigap Plan L Cover?

Medigap Plan L offers a variety of benefits, making it a versatile choice for many seniors. Here’s a closer look at what you can expect from Medigap Plan L:

Core Benefits

- Part A Coinsurance and Hospital Costs: Medigap Plan L covers 100% of your Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted.

- Part B Coinsurance or Copayment: Medigap Plan L covers 75% of your Part B coinsurance or copayment. This can be a significant help if you have frequent doctor visits or outpatient care.

- First Three Pints of Blood: Medigap Plan L covers 75% of the cost for the first three pints of blood you need each year.

- Part A Hospice Care Coinsurance or Copayment: Medigap Plan L covers 75% of your hospice care coinsurance or copayment, making end-of-life care more affordable.

- Skilled Nursing Facility Care Coinsurance: Medigap Plan L covers 75% of your skilled nursing facility care coinsurance.

- Part A Deductible: Medigap Plan L covers 75% of your Part A deductible. This can be a big relief when you have to stay in the hospital.

✓ = 100% coverage

✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted)

What Medigap Plan L Doesn’t Cover

While Medigap Plan L offers substantial coverage, it doesn’t cover everything. It’s important to know what’s not included so you can plan accordingly:

- Part B Deductible: Medigap Plan L doesn’t cover your Part B deductible.

- Part B Excess Charges: If your doctor charges more than Medicare approves, Medigap Plan L won’t cover the excess charges.

- Foreign Travel Emergency: Medigap Plan L doesn’t cover emergency care if you travel outside the U.S.

Costs Associated with Medigap Plan L

Monthly Premiums

One of the appealing aspects of Medigap Plan L is its relatively lower premiums compared to other Medigap plans. Premiums can vary based on your age, location, and the insurance company you choose.

Out-of-Pocket Limits

Medigap Plan L is unique because it has an annual out-of-pocket limit. For 2024, this limit is $3,470. This means once you’ve spent $3,530 out-of-pocket on covered services, Medigap Plan L pays 100% of your covered services for the rest of the year. My friend Bob, who has multiple chronic conditions, found this particularly reassuring because it helped him budget his healthcare costs more predictably.

Comparing Medigap Plan L to Other Medigap Plans

Medigap Plan L vs. Plan F and Plan G

Medigap Plan L offers significant coverage, but how does it stack up against other popular plans like Plan F and Plan G?

- Plan F: Plan F is often referred to as the “Cadillac” of Medigap plans because it covers almost everything. However, it comes with higher premiums and is only available to those who were eligible for Medicare before January 1, 2020.

- Plan G: Plan G is similar to Plan F but doesn’t cover the Part B deductible. It offers extensive coverage but also comes with higher premiums than Medigap Plan L.

Medigap Plan L’s Unique Balance

Medigap Plan L strikes a balance between coverage and cost. If you don’t mind covering a portion of your medical expenses out-of-pocket and prefer lower premiums, Medigap Plan L could be a great fit.

Eligibility and Enrollment

Who is Eligible for Medigap Plan L?

To be eligible for Medigap Plan L, you need to be enrolled in Medicare Part A and Part B. It’s that simple! Most people become eligible for Medicare when they turn 65, but there are other circumstances, like certain disabilities, that can make you eligible earlier.

When and How to Enroll

You can enroll in Medigap Plan L during your Medigap Open Enrollment Period, which starts the first month you have Medicare Part B and are 65 or older. This period lasts for six months, and during this time, you have guaranteed issue rights. This means you can’t be denied coverage or charged higher premiums due to pre-existing conditions.

To enroll, simply contact the insurance company offering Medigap Plan L in your area. You can compare different companies’ offerings to find the best rate and customer service. When I helped my Aunt Mary sign up, we spent a little extra time comparing options and found a great plan that fit her needs perfectly.

Advantages and Disadvantages of Medigap Plan L

Pros of Medigap Plan L

- Lower Premiums: Medigap Plan L generally has lower premiums than other Medigap plans, making it more affordable on a monthly basis.

- Out-of-Pocket Limit: The annual out-of-pocket limit offers peace of mind by capping your expenses.

- Coverage for Essential Services: Medigap Plan L covers many essential services, reducing the burden of unexpected medical costs.

Cons of Medigap Plan L

- Limited Coverage: Medigap Plan L doesn’t cover everything. You’ll still have some out-of-pocket costs until you reach the annual limit.

- No Part B Deductible Coverage: Unlike some other plans, Medigap Plan L doesn’t cover the Part B deductible.

Frequently Asked Questions

What Happens if I Travel Outside the U.S.?

Medigap Plan L doesn’t cover foreign travel emergencies. If you plan to travel frequently, you might want to consider a plan that includes this coverage or look into a separate travel insurance policy.

What if My Healthcare Needs Change?

If your healthcare needs change, you can switch Medigap plans. However, outside of your open enrollment period, you may be subject to medical underwriting, which could affect your eligibility and premiums. It’s always best to review your options carefully and plan ahead.

Conclusion

Understanding Medigap Plan L and how it fits into your overall healthcare plan is crucial for making informed decisions. This plan offers a balance of coverage and cost, with lower premiums and an annual out-of-pocket limit that can help manage your expenses. Whether you’re just turning 65 or looking to switch plans, take the time to compare your options and find the best fit for your needs.