Medicare Part D

Essential Highlights

Understanding Medigap Plan D

What is Medigap?

The Basics

First things first, let’s talk about what Medigap is. Medigap Plan D, also known as Medicare Supplement Insurance, is designed to fill the gaps in Original Medicare (Part A and Part B). These gaps include things like copayments, coinsurance, and deductibles that you’d otherwise have to pay out of pocket.

Why You Might Need It

Original Medicare covers a lot, but it doesn’t cover everything. For example, there’s no cap on how much you might spend out of pocket each year. This is where Medigap Plan D comes in handy, providing additional coverage and peace of mind.

Understanding Medigap Plan D

What Exactly is Medigap Plan D?

Medigap Plan D is one of the standardized Medigap plans available. It’s not as comprehensive as Plan F or G, but it covers a substantial amount of out-of-pocket costs. Think of it as a middle-of-the-road option that balances coverage and cost.

Coverage Details

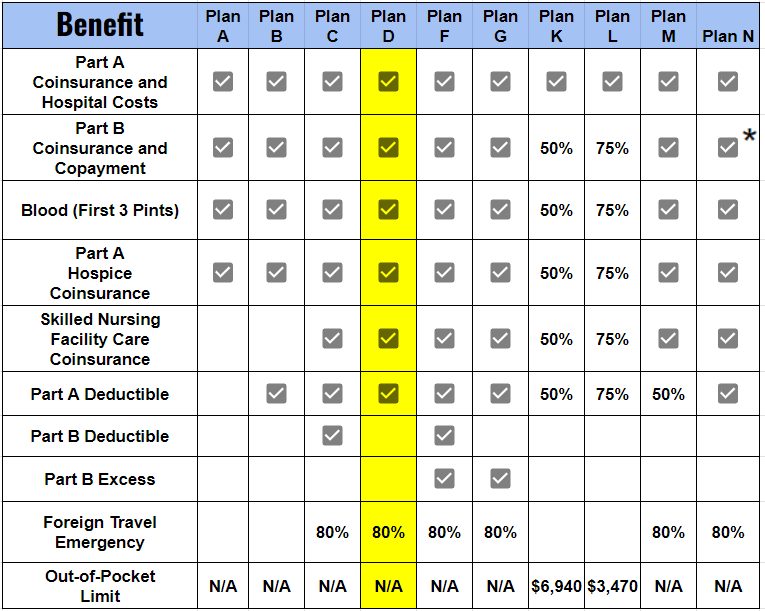

Here’s a breakdown of what Medigap Plan D covers:

- Medicare Part A Coinsurance and Hospital Costs: Up to an additional 365 days after Medicare benefits are used up. This is crucial for those long hospital stays.

- Medicare Part B Coinsurance or Copayment: This can save you from those small yet frequent doctor visit costs.

- Blood (First 3 Pints): If you need a blood transfusion, the first three pints are covered.

- Part A Hospice Care Coinsurance or Copayment: Ensures end-of-life care is affordable.

- Skilled Nursing Facility Care Coinsurance: Covers the coinsurance costs if you need rehabilitation.

- Medicare Part A Deductible: One less thing to worry about when you have to stay in the hospital.

However, it’s important to note what Medigap Plan D doesn’t cover:

- Medicare Part B Deductible: You’ll still be responsible for this amount.

- Part B Excess Charges: Some doctors charge more than what Medicare pays, and Medigap Plan D won’t cover this extra amount.

Mrs. Thompson, who was initially overwhelmed by her medication expenses. Once she enrolled in a Medicare Part D plan, she saw her monthly medication costs drop by half.

✓ = 100% coverage

✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted)

Mr. Smith, who loved to travel. For him, the flexibility of Medigap Plan D was crucial because he wanted to ensure he could see any doctor wherever he was. On the other hand, his friend Mrs. Lee preferred the extra benefits of a Medicare Advantage plan because she had specific healthcare needs that were better addressed through that option.

How Medigap Plan D Works

Eligibility and Enrollment

So, who can get Medigap Plan D? Generally, you need to be enrolled in Medicare Part A and Part B. The best time to enroll is during your Medigap Open Enrollment Period, which starts the month you turn 65 and are enrolled in Part B. During this time, you can buy any Medigap policy sold in your state, regardless of your health.

Costs

Now, let’s talk money. Medigap Plan D comes with a monthly premium, which varies depending on your location and the insurance company. Besides the premium, you’ll still need to pay your Medicare Part B premium.

Out-of-pocket costs are what you pay for deductibles, coinsurance, and copayments. While Medigap Plan D covers a lot of these, you’ll still have some expenses, particularly for services not fully covered by Medicare.

Using Medigap Plan D

Using your Medigap Plan D is straightforward. When you visit a doctor or hospital that accepts Medicare, they’ll bill Medicare first. Medicare pays its share, and then your Medigap Plan D kicks in to cover its part. This coordination ensures you’re not left with hefty bills.

Comparing Medigap Plan D with Other Plans

Medigap Plan D vs. Other Medigap Plans

Medigap Plan D isn’t the only option out there. For instance, Plan F is the most comprehensive but is no longer available to new Medicare beneficiaries. Plan G is similar to Plan F but doesn’t cover the Part B deductible.

Medigap Plan D covers a lot, but if you’re looking for even more coverage (like for Part B excess charges), you might consider Plan G. On the other hand, if you want to save on premiums and are okay with paying the Part B deductible, Medigap Plan D might be just right.

Medigap Plan D vs. Medicare Advantage

Medicare Advantage (Part C) is another option entirely. These plans are offered by private companies approved by Medicare and often include additional benefits like dental, vision, and prescription drugs.

However, with Medicare Advantage, you typically have a network of doctors and hospitals you must use. Medigap Plan D, including Plan D, allows you to see any doctor that accepts Medicare. It’s a trade-off between flexibility and additional benefits.

Advantages and Disadvantages of Medigap Plan D

Advantages

- Predictable Out-of-Pocket Costs: Knowing what you’ll pay each month can help you budget better.

- Freedom to Choose: See any doctor or hospital that accepts Medicare without needing referrals.

- Comprehensive Coverage: Covers many of the gaps left by Original Medicare, reducing your out-of-pocket expenses.

Disadvantages

- Monthly Premiums: You need to budget for these in addition to your Part B premium.

- No Coverage for Part B Deductible or Excess Charges: If these are important to you, consider other plans like Plan G.

- Limited Travel Coverage: If you travel internationally, Medigap Plan D might not be the best fit.

Making an Informed Decision

When choosing a plan, it’s essential to consider your personal health care needs and financial situation. Think about your current health, how often you visit the doctor, and whether you have any ongoing medical conditions.

Conclusion

Medigap Plan D offers solid coverage for many of the gaps in Original Medicare. It’s a good middle-ground option that balances coverage and cost, making it a great choice for many seniors.

Don’t be afraid to seek help. A licensed insurance agent at 411Medicare can provide personalized advice based on your specific circumstances. Take the time to review your current coverage and consider if Medigap Plan D is the right fit for you.