Medigap Plan A

Essential Highlights

Understanding Medigap Plan A

What is Medigap?

The Basics of Medigap

Let’s start with the basics. Medigap Plan A, also known as Medicare Supplement Insurance, is designed to work alongside your Original Medicare (Part A and Part B) to cover some of the costs that Medicare doesn’t. Think of it as a safety net for your healthcare expenses. While Original Medicare covers a significant portion of your medical costs, there are still copayments, coinsurance, and deductibles that you might have to pay out-of-pocket. That’s where Medigap Plan A comes in.

How Medigap Plans Work

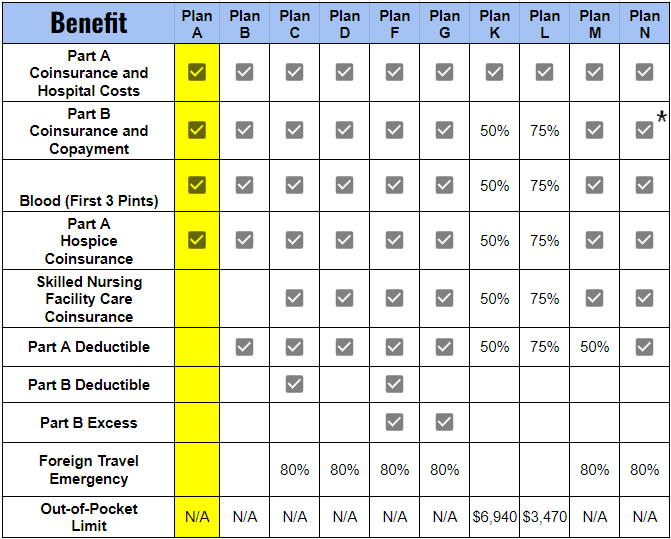

Medigap plans are offered by private insurance companies and are standardized, meaning each plan offers the same basic benefits regardless of which company sells it. The main difference you’ll find between plans from different companies is the cost. There are ten different Medigap plans, labeled A through N, and today we’re focusing on Medigap Plan A.

Why Consider Medigap Plan A?

Meeting Your Basic Coverage Needs

You might wonder why you should consider Medigap Plan A specifically. Well, Medigap Plan A is often seen as the entry-level plan because it covers the essential benefits that you might need. It’s a great starting point for those who want basic coverage without paying for benefits they might not use.

Notes

- ✓ = 100% coverage

- ✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted)

Coverage Details of Medigap Plan A

What Medigap Plan A Covers

Let’s dive into what Medigap Plan A actually covers. Here are the key benefits:

- Part A Coinsurance and Hospital Costs: This plan covers hospital costs up to an additional 365 days after your Medicare benefits are used up. This can be a lifesaver if you find yourself needing extended hospital care.

- Part B Coinsurance or Copayment: It also covers your Part B coinsurance or copayments, which means those frequent doctor visits will cost you less out-of-pocket.

- First Three Pints of Blood: Each year, if you need blood for medical procedures, Medigap Plan A covers the first three pints.

- Part A Hospice Care Coinsurance or Copayment: Hospice care is essential for many, and Medigap Plan A ensures that your coinsurance or copayments for this type of care are covered.

What Medigap Plan A Does Not Cover

Limitations and Exclusions

While Medigap Plan A provides essential coverage, it’s important to know what it doesn’t cover:

- Skilled Nursing Facility Care Coinsurance: If you need skilled nursing care, Medigap Plan A doesn’t cover this.

- Part A Deductible: You will still need to pay the Part A deductible out-of-pocket.

- Part B Deductible: The annual Part B deductible isn’t covered either.

- Part B Excess Charges: If your doctor charges more than what Medicare approves, you will need to cover these excess charges.

- Foreign Travel Emergency Care: Medigap Plan A doesn’t cover emergency care when you’re traveling outside the United States.

Eligibility and Enrollment

Who Can Enroll

Now, who exactly is eligible for Medigap Plan A? If you’re 65 or older and enrolled in Medicare Part A and Part B, you can apply for Medigap Plan A. The best time to enroll is during your Medigap Open Enrollment Period, which starts the month you turn 65 and are enrolled in Part B. During this period, you have a guaranteed issue right, meaning you can buy any Medigap policy sold in your state without health screening or being charged more due to pre-existing conditions. Outside of your open enrollment, you can apply with Medical Underwriting or if you qualify from one of the many Special Enrollment periods such as leaving employer coverage.

Cost Considerations

Premiums and Out-of-Pocket Costs

Let’s talk about costs. Medigap Plan A requires you to pay a monthly premium to the private insurance company providing your plan. This premium is in addition to the Part B premium you pay to Medicare. The exact amount varies by state and insurance provider. It’s essential to shop around and compare premiums to find the best deal for your budget.

Balancing Costs and Benefits

It’s crucial to balance the cost of the premium with the benefits you receive. For example, if you rarely travel outside the U.S., not having foreign travel emergency care coverage might not be a big deal for you. However, if you frequently see specialists who charge more than Medicare’s approved amount, you might want to consider a plan that covers Part B excess charges.

Comparing Medigap Plan A with Other Medigap Plans

Understanding Differences

Medigap Plan A is just one of ten standardized plans available. Each plan offers a different level of coverage. Here’s a quick comparison:

- Plan B: Similar to Plan A but also covers the Part A deductible.

- Plan C and Plan F: Comprehensive plans covering almost all gaps in Original Medicare (Note: Plan F is only available to those eligible before January 1, 2020).

- Plan G: Similar to Plan F but doesn’t cover the Part B deductible.

- Plan K and Plan L: These plans offer lower premiums but higher out-of-pocket costs.

- Plan N: Covers most benefits with lower premiums but requires copayments for doctor visits and emergency room visits.

Choosing the right plan depends on your specific healthcare needs and budget. It’s often helpful to consult with an insurance representative who can provide personalized advice based on your situation.

How to Choose the Right Plan

Decision-Making Tips

Choosing the right Medigap plan can feel overwhelming, but here are some tips to help you decide:

- Assess Your Healthcare Needs: Think about your current health and any chronic conditions. If you have frequent doctor visits, a plan that covers more Part B costs might be beneficial.

- Consider Your Budget: Calculate how much you can afford to pay in premiums versus potential out-of-pocket costs. Remember, the cheapest plan isn’t always the best if it doesn’t cover what you need.

- Consult an Expert: An insurance representative can provide detailed comparisons and help you understand the pros and cons of each plan.

Frequently Asked Questions

What happens if I have a pre-existing condition?

If you enroll during your Medigap Open Enrollment Period, you have guaranteed issue rights, meaning the insurance company cannot deny you coverage or charge you more due to pre-existing conditions.

Can I switch from one Medigap plan to another?

Yes, but it may depend on the rules in your state and whether you have guaranteed issue rights at the time you want to switch. It’s best to consult with an insurance representative to understand your options.

Will my Medigap Plan A policy be renewed automatically each year?

Yes, as long as you continue to pay your premiums, your Medigap policy is guaranteed renewable.

Conclusion

To wrap things up, Medigap Plan A is an option for those looking for basic coverage to complement their Original Medicare. It covers essential costs like hospital stays and doctor visit coinsurance, making healthcare more affordable. Remember to assess your healthcare needs, consider your budget, and consult with an expert at 411Medicare to find the best plan for you.