Medigap Plan B

Essential Highlights

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, is designed to fill the gaps left by Original Medicare (Parts A and B). Original Medicare covers a lot, but it doesn’t cover everything. That’s where Medigap comes in—it helps pay for some of the healthcare costs that Medicare doesn’t cover, like copayments, coinsurance, and deductibles.

How Medigap Supplements Original Medicare

Think of Medigap as a safety net. While Original Medicare covers your hospital and medical expenses, Medigap ensures you don’t get hit with unexpected bills. It’s especially useful for those on a fixed income who need to manage their healthcare costs predictably.

Basics of Medigap Plan B

Overview of Medigap Plans

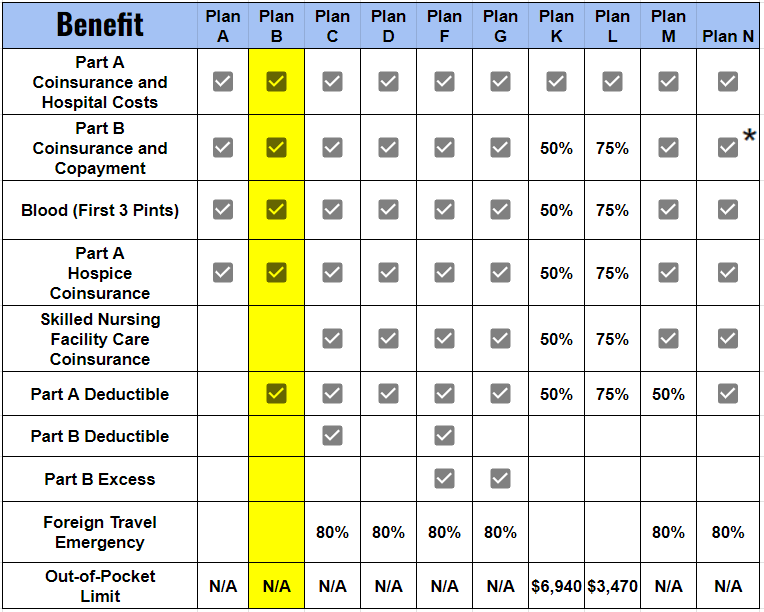

Medigap plans are standardized, meaning that each plan offers the same basic benefits no matter which insurance company sells it. The main difference is the cost. There are ten Medigap plans, labeled A through N. Each plan offers a different level of coverage, so it’s important to understand what each one covers.

Specifics of Medigap Plan B

Coverage Details

Medigap Plan B covers several key areas:

- Part A coinsurance and hospital costs: This includes hospital stays up to an additional 365 days after Medicare benefits are used up.

- Part B coinsurance or copayment: This helps with the costs associated with doctor visits and outpatient care.

- First three pints of blood: If you need a blood transfusion, Plan B covers the first three pints.

- Part A hospice care coinsurance or copayment: This covers some of the costs associated with hospice care.

Costs Associated with Medigap Plan B

While Medigap Plan B offers substantial coverage, it’s important to understand the costs involved:

- Premiums: You’ll pay a monthly premium for your Medigap Plan B policy in addition to your Medicare Part B premium.

- Out-of-pocket costs: While Plan B reduces many of your out-of-pocket expenses, you may still have some costs depending on the care you receive.

✓ = 100% coverage

✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted)

What Medigap Plan B Does Not Cover

Exclusions and Limitations

While Medigap Plan B provides robust coverage, it’s also crucial to know what it doesn’t cover:

- Prescription Drugs: Medigap Plan B does not cover prescription drugs. For this, you need to enroll in a Medicare Part D plan.

- Long-term Care: Medigap does not cover long-term care, such as custodial care in a nursing home or assisted living facility.

- Vision and Dental Care: Routine vision and dental care, including eyeglasses and dentures, are not covered by Medigap Plan B.

- Hearing Aids: Hearing aids and exams for fitting them are also excluded.

- Private-Duty Nursing: If you require private-duty nursing, Medigap Plan B will not cover these costs.

- Overseas Coverage: Routine care outside the United States is generally not covered, although emergency care during travel may be partially covered by some Medigap plans, but not Plan B.

Benefits of Medigap Plan B

Financial Security

Reducing Out-of-Pocket Expenses

One of the biggest benefits of Medigap Plan B is the reduction in out-of-pocket expenses. By covering things like copayments and coinsurance, Medigap Plan B helps you avoid surprise medical bills.

Predictable Healthcare Costs

With Medigap Plan B, your healthcare costs become more predictable. This can be a huge relief for those on a fixed income, as it helps with budgeting and financial planning.

Access to Care

Freedom to Choose Any Doctor or Hospital

One of the great things about Medigap is that it allows you to choose any doctor or hospital that accepts Medicare. You don’t have to worry about networks or referrals, which gives you more control over your healthcare decisions.

No Need for Referrals to See Specialists

Unlike some other types of insurance, Medigap does not require referrals to see specialists. This means you can directly access the care you need without extra steps.

Nationwide Coverage

Coverage Across the United States

Medigap policies offer nationwide coverage, which means you’re covered anywhere in the U.S. This is especially beneficial for those who travel frequently or spend part of the year in different states.

Portability When Moving or Traveling

If you decide to move or travel extensively, you don’t have to worry about losing your coverage. Your Medigap plan goes with you, providing peace of mind wherever you are.

How to Choose Medigap Plan B

Assessing Your Healthcare Needs

Current and Anticipated Healthcare Expenses

When considering Medigap Plan B, it’s essential to evaluate your current and anticipated healthcare expenses. Think about your medical history, any ongoing treatments, and potential future health issues.

Personal Preferences and Lifestyle

Your personal preferences and lifestyle also play a role. Do you travel often? Do you prefer to have the flexibility to see any doctor you choose? These factors can influence your decision.

Comparing Plans

Understanding Differences Between Medigap Plans

It’s crucial to understand the differences between Medigap plans. While Plan B offers solid coverage, other plans might provide additional benefits that better suit your needs. For instance, Plan F covers more out-of-pocket costs but may come with higher premiums.

Using Resources Like Medicare’s Website or Consulting an Insurance Agent

Medicare’s website is a valuable resource for comparing Medigap plans. Additionally, consulting with an insurance agent who specializes in Medicare can provide personalized guidance based on your situation.

Reviewing Costs

Comparing Premiums and Out-of-Pocket Costs

When choosing a Medigap plan, compare the premiums and out-of-pocket costs. Sometimes a plan with a higher premium can save you money in the long run by reducing your out-of-pocket expenses.

Evaluating the Financial Impact of Plan B

Consider how Medigap Plan B will impact your overall financial situation. Look at both the immediate costs and the potential savings on medical expenses.

Eligibility and Enrollment

Eligibility Criteria

To be eligible for Medigap, you must be enrolled in Medicare Part A and Part B. Most people qualify for Medicare at age 65, but younger people with certain disabilities may also be eligible.

Enrollment Periods

Initial Enrollment Period

Your best time to buy a Medigap policy is during your Medigap Open Enrollment Period. This is a six-month period that starts the first month you’re 65 or older and enrolled in Part B. During this time, you have the right to buy any Medigap policy offered in your state, regardless of your health condition.

Guaranteed Issue Rights

In some situations, you have a guaranteed issue right to buy a Medigap policy, meaning the insurance company can’t deny you coverage or charge you more because of your health. For example, if you lose your health coverage through no fault of your own, you may have a guaranteed issue right.

Special Enrollment Periods

There are other special enrollment periods that may apply, such as moving out of your Medigap plan’s service area. It’s important to understand these scenarios to ensure you have continuous coverage.

Common Concerns

Differences Between Medigap and Medicare Advantage

One common question is the difference between Medigap and Medicare Advantage. Medigap supplements Original Medicare, while Medicare Advantage plans are private Medicare plans and is an alternative to Original Medicare, they often including additional benefits like vision and dental coverage.

How Medigap Plan B Interacts with Original Medicare

Medigap Plan B works alongside Original Medicare. Medicare pays its share of the approved amount for covered services, then Medigap Plan B pays its share. This coordination helps lower your out-of-pocket costs.

Specific Scenarios

Traveling Out of State

Many people worry about coverage when traveling out of state. With Medigap Plan B, you don’t have to. It provides nationwide coverage, ensuring you’re protected no matter where you go in the U.S.

Switching from Another Medigap Plan to Plan B

If you’re considering switching from another Medigap plan to Plan B, it’s important to understand the implications. You may have to go through medical underwriting, and your premiums could be higher based on your health status.

Conclusion

Understanding Medigap Plan B is essential for making informed healthcare decisions. It’s designed to fill the gaps left by Original Medicare, providing financial security and flexibility in choosing healthcare providers. However, it’s crucial to remember what it doesn’t cover, such as prescription drugs, long-term care, and routine vision and dental care.

If you still have questions or need more personalized advice, don’t hesitate to consult with us at 411Medicare. We can provide the guidance you need to make the best choice for your healthcare needs.