Medigap Plan G

Essential Highlights

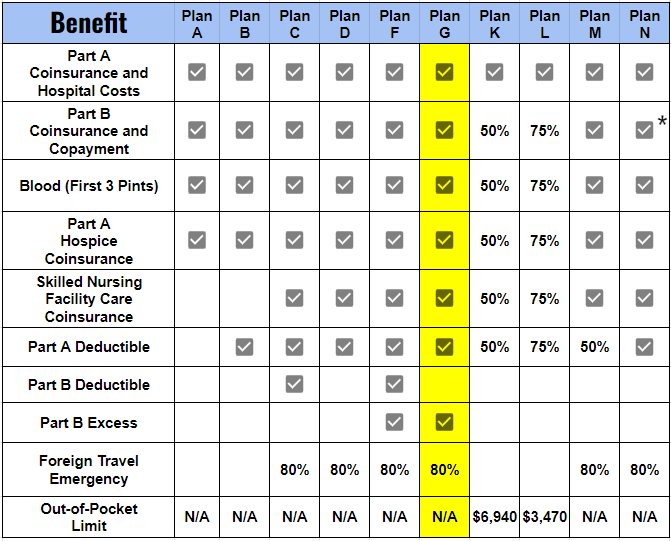

Medicare Supplement Plan G is widely favored among beneficiaries as one of the top Medigap plans.

Plan G provides coverage for all Medicare gaps with the exception of the Part B deductible.

The optimal moment to sign up for Plan G is within the timeframe of your Medigap Open Enrollment period.

What is Medicare Plan G?

Medicare Plan G is one of the ten Medigap (Medicare Supplement) plans available to those with Original Medicare (Parts A and B). Think of it as a safety net that helps cover many of the out-of-pocket costs that Original Medicare doesn’t cover. These include things like copayments, coinsurance, and deductibles.

Differentiation from Other Medicare Plans

Medicare Plan G stands out because it offers one of the most comprehensive coverages among Medigap plans. While Original Medicare covers a lot, it doesn’t cover everything. That’s where Plan G steps in, taking care of most of the gaps.

Who is Eligible for Medicare Plan G?

Eligibility Criteria

- Medicare: Must have both Medicare Part A and Part B.

- Enrollment Periods: The best time to enroll is during your Medigap Open Enrollment Period. This is a six-month period that starts the month you turn 65 and are enrolled in Medicare Part B. During this time, you have a guaranteed issue right, meaning you can get any Medigap policy sold in your state, regardless of health issues.

- Special Election Period: Certain qualifying life events may allow you to enroll with a guarantee issue.

- Health Requirements: During the Open Enrollment Period, you can’t be denied coverage or charged more due to pre-existing conditions. Outside of this period, however, you might face medical underwriting, which could affect your eligibility and premiums.

Key Benefits of Medicare Plan G

Coverage Details

Medicare Plan G is quite robust. It covers:

- Part A Coinsurance and Hospital Costs: This includes coverage for up to an additional 365 days after Medicare benefits are exhausted.

- Part B Coinsurance or Copayment: This means you won’t have to pay the usual 20% coinsurance that Original Medicare charges.

- First Three Pints of Blood: If you need a blood transfusion, Plan G covers the first three pints each year.

- Part A Hospice Care Coinsurance or Copayment: Plan G covers these costs, which can be significant.

- Skilled Nursing Facility Care Coinsurance: If you need skilled nursing care, Plan G helps cover the costs.

- Part A Deductible: Original Medicare has a deductible for hospital stays, but Plan G covers this.

- Foreign Travel Emergency: If you travel outside the U.S., Plan G covers 80% of emergency health care services.

Notes

- ✓ = 100% coverage

- ✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted).

Comparison with Original Medicare

While Original Medicare provides solid foundational coverage, there are many gaps that can leave you with substantial out-of-pocket costs. Medicare Plan G fills in most of these gaps, giving you peace of mind and more predictable healthcare costs.

Costs Associated with Medicare Plan G

Premiums and Out-of-Pocket Costs

- Monthly Premiums: The cost of Medicare Plan G varies based on factors like your age, gender, location, and health. On average, you might expect to pay between $100 to $300 per month.

- Out-of-Pocket Costs: With Medicare Plan G, your primary out-of-pocket cost is the Medicare Part B deductible, which is $226 in 2024. After this deductible is met, Plan G covers nearly all other expenses.

Advantages of Medicare Plan G

Why Choose Medicare Plan G?

- Comprehensive Coverage: Medicare Plan G offers extensive coverage, making it one of the most comprehensive Medigap plans available.

- Predictable Costs: With Medicare Plan G, most of your out-of-pocket costs are covered, except for the Part B deductible.

- Flexibility: You can see any doctor or specialist that accepts Medicare, without needing referrals or being restricted to a network.

Comparison with Other Medigap Plans

Compared to other Medigap plans, Medicare Plan G offers a balance of comprehensive coverage and moderate premiums. While Plan F offers slightly more coverage, it is no longer available to new Medicare enrollees after January 1, 2020, making Plan G the next best option.

Disadvantages of Medicare Plan G

Potential Drawbacks

- Higher Premiums: Medicare Plan G can have higher premiums compared to some other Medigap plans, like Plan K or Plan L.

- Does Not Cover Part B Deductible: Unlike Plan F, Medicare Plan G does not cover the Medicare Part B deductible, though this amount is relatively small.

How to Enroll in Medicare Plan G

Enrollment Process

- Research and Compare Plans: Look into different insurance companies and compare their Medicare Plan G offerings.

- Apply During Open Enrollment: Apply during your Medigap Open Enrollment Period to avoid medical underwriting and ensure guaranteed acceptance.

- Provide Necessary Documentation: Be ready to provide your Medicare card, proof of age, and any other required documents.

Important Timelines and Deadlines

- Medigap Open Enrollment Period: This six-month period begins when you are both 65 and enrolled in Medicare Part B. Missing this window can lead to higher costs or denial of coverage due to medical underwriting.

Frequently Asked Questions

Common Concerns and Clarifications

What is the difference between Plan G and Plan N?

Plan N is another Medigap plan that is similar to Medicare Plan G but requires copayments for doctor and emergency room visits. It typically has lower premiums but might result in higher out-of-pocket costs.

Can I switch from another Medigap plan to Medicare Plan G?

Yes, you can switch, but you may be subject to medical underwriting unless you have a Special Election Period (SEP).

Tips for Choosing the Right Plan

Guidance and Advice

- Assess Your Healthcare Needs: Consider your current and anticipated healthcare needs. If you expect frequent medical services, Medicare Plan G’s comprehensive coverage might be worth the higher premium.

- Evaluate Your Budget: Balance the cost of premiums with your ability to pay out-of-pocket costs. Medicare Plan G offers predictable expenses, which can be helpful for budgeting.

- Consult with an Expert: Don’t hesitate to talk to a Medicare expert or insurance agent to help you understand your options and make an informed decision.

Conclusion

Medicare Plan G offers comprehensive coverage, predictable costs, and peace of mind. It’s an excellent choice for those who want extensive coverage without worrying about most out-of-pocket expenses. Remember, understanding your healthcare options is crucial to making the best decision for your needs.

If you have more questions or need personalized advice, feel free to reach out. We are here to help you navigate the complexities of Medicare and find the best plan for your situation.

Key Details Summarized

Plan G is often considered the most economical Medigap option since the sole expense is the Part B deductible.

Plan G will take care of the additional expenses after the deductible has been satisfied, as long as Medicare covers the service.

If you do not sign up for Plan G within your Medigap Open Enrollment period, you may be required to respond to health inquiries based on your location.