Medigap Plan K

Essential Highlights

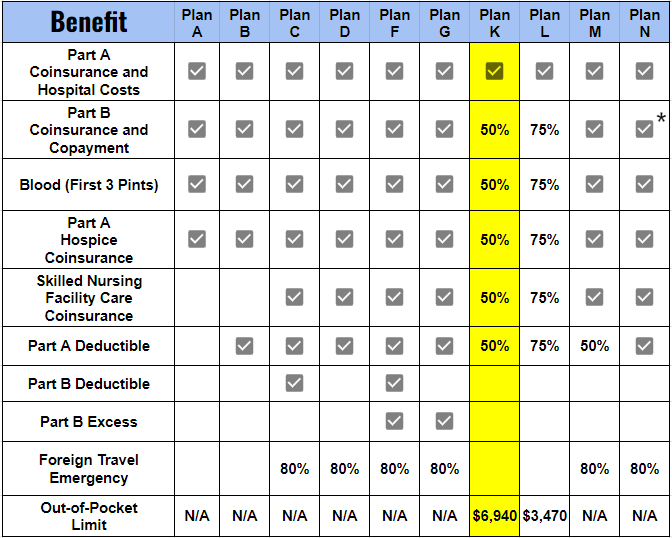

Medicare Plan K is among the ten standardized Medigap plans available.

Plan K provides coverage for up to 50% of various Medicare benefits and includes a set limit on out-of-pocket expenses to help control your overall costs.

Medigap Plan K excludes coverage for the Part B deductible, Part B excess charges, and emergency medical expenses during foreign travel.

Understanding Medicare Plan K

What is Medicare Plan K?

Before we jump into the specifics of Medicare Plan K, let’s start with a quick overview of Medicare. Medicare is a federal health insurance program primarily for people aged 65 and older. It helps cover many healthcare costs, but not everything. That’s where Medicare Supplement Insurance, also known as Medigap, comes in. Medigap plans help cover some of the costs that Medicare doesn’t, like copayments, coinsurance, and deductibles.

So, what about Medicare Plan K? It’s one of the Medigap plans, and it’s designed to help with those extra costs that can add up. Think of it as a safety net for your healthcare expenses. But what makes Plan K unique?

Key Features of Medicare Plan K

Coverage Details

One of the key aspects of Medicare Plan K is that it offers partial coverage for many healthcare costs. Here’s a breakdown of what Plan K covers:

-

-

-

-

- Part A coinsurance and hospital costs: If you end up in the hospital, Plan K will cover these costs for up to an additional 365 days after your Medicare benefits are used up. That’s a whole extra year of hospital coverage.

- Part B coinsurance or copayment: This covers 50% of the costs when you visit the doctor or have outpatient treatments.

- First three pints of blood: Plan K covers 50% of the first three pints.

- Part A hospice care coinsurance or copayment: If you need hospice care, Plan K covers 50% of these costs.

- Skilled nursing facility care coinsurance: This is another area where Plan K covers 50% of the costs.

- Part A deductible: Medicare Plan K covers 50% of the deductible for hospital stays.

- Part B deductible and excess charges: These are not covered by Plan K.

-

-

-

You might notice a pattern here—Medicare Plan K covers 50% of many services. It’s designed this way to offer a balance between coverage and cost.

Notes

- ✓ = 100% coverage

- ✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted)

Out-of-Pocket Limits

One of the standout features of Medicare Plan K is its out-of-pocket limit. This means there’s a cap on how much you have to spend out of your own pocket for covered services each year. Once you hit this limit, Plan K covers 100% of your approved costs for the rest of the year.

Benefits of Medicare Plan K

Financial Protection

Medicare Plan K can be a lifesaver when it comes to managing unexpected healthcare costs. Imagine you’re faced with multiple hospital visits or need long-term treatment—those costs can skyrocket quickly. With Plan K, you have a cushion that helps absorb these unexpected expenses.

Predictable Costs

One of the great things about Medicare Plan K is the predictability it offers. Knowing that there’s a limit to how much you’ll have to pay out of pocket can bring peace of mind. You can budget your healthcare expenses better, knowing that once you hit that cap, you won’t have to worry about additional costs for covered services.

Considerations When Choosing Medicare Plan K

Budget Considerations

When choosing a Medicare plan, it’s crucial to think about your budget. Medicare Plan K might be a good fit if you’re looking for lower monthly premiums while still having some coverage for unexpected medical expenses. It’s a bit of a trade-off: you pay less each month but take on some of the costs if you need medical care.

Healthcare Needs

Your healthcare needs are another important factor. If you’re generally healthy and don’t expect frequent doctor visits, Medicare Plan K’s partial coverage might be sufficient. However, if you have chronic conditions or anticipate needing extensive medical care, you’ll need to weigh the out-of-pocket costs and decide if Plan K’s structure makes sense for you.

How to Enroll in Medicare Plan K

Eligibility Requirements

To enroll in Medicare Plan K, you need to be eligible for Medicare Parts A and B. This typically means you’re 65 or older or have certain disabilities.

Enrollment Process

Enrolling in Medicare Plan K is straightforward but can feel overwhelming if you’re new to Medicare. Here’s a step-by-step guide:

- Determine Your Eligibility: Make sure you meet the basic criteria.

- Compare Plans: Look at Plan K alongside other Medigap plans to see which best meets your needs.

- Complete the Application: Fill out the necessary forms with a trusted insurance representative.

- Submit and Wait for Approval: After submitting your application, you’ll wait for approval. Once approved, you’re all set!

If this process sounds daunting, don’t worry—help is available. You can reach out to a licensed insurance agent at 411Medicare who can guide you through the process and answer any questions you might have.

Frequently Asked Questions about Medicare Plan K

How does Plan K compare to other Medigap plans?

Medicare Plan K is unique because of its 50% coverage and out-of-pocket limit. Other Medigap plans might offer more comprehensive coverage but typically come with higher premiums.

What are the costs involved?

Costs for Medicare Plan K include your monthly premium, any coinsurance or copayments, and other out-of-pocket expenses up to the annual limit. It’s a good idea to compare these costs with other plans to see what fits your budget best.

How does Medicare Plan K work with Original Medicare?

Medicare Plan K works alongside Original Medicare (Parts A and B). Medicare pays its share of approved amounts for covered services first, and then Plan K covers its portion. This helps reduce the amount you pay out of pocket.

Conclusion

Medicare Plan K offers a balanced approach to managing healthcare costs. It provides partial coverage for many services, has an annual out-of-pocket limit, and can help you maintain predictable healthcare expenses.

If you’re considering Medicare Plan K, take some time to evaluate your healthcare needs and budget. Reach out to 411Medicare for more information or a personal consultation—We’re here to help you navigate these decisions.

Key Details Summarized

Medigap Plan K typically comes with a reduced monthly premium due to its coverage of only 50% of the expenses associated with many Medicare services.

The Plan K’s maximum out-of-pocket limit is designed to limit your expenses, although this threshold is subject to annual adjustments.

Once you hit the maximum out-of-pocket limit, your cost will be covered at 100% for the rest of the year.