Medigap Plan M

Essential Highlights

Plan M is a Medicare Supplement Plan that offers beneficiaries enhanced coverage for their medical expenses.

You pay half of the Part A deductible in exchange for a reduced monthly premium.

Plan M is offered by a limited number of carriers in comparison to other supplemental plans, such as Plan G.

Understanding the Basics of Medicare

What is Medicare?

Before we get into the specifics of Medicare Plan M, let’s start with the basics. Medicare is a federal health insurance program primarily for people who are 65 or older, though younger folks with certain disabilities can also qualify. It’s divided into different parts: Part A covers hospital stays, Part B covers doctor visits, Part C (Medicare Advantage) combines Part A and B benefits (and often more), and Part D covers prescription drugs.

What is Medigap?

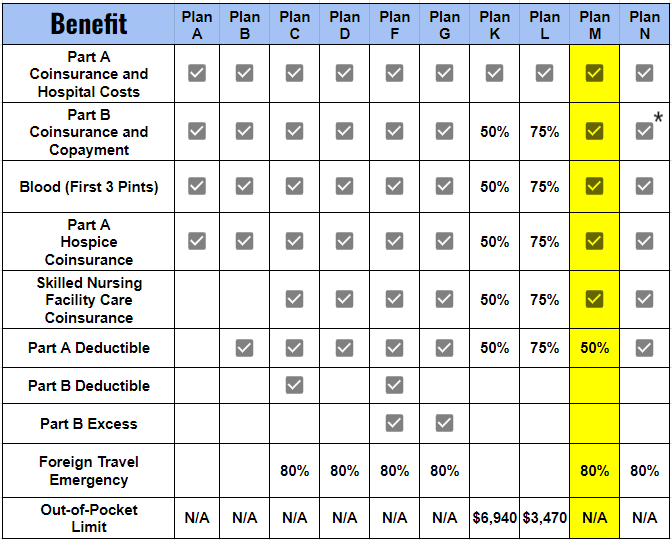

Now, Medigap, also known as Medicare Supplement Insurance, comes into play. Medigap plans help cover some of the healthcare costs that Original Medicare (Parts A and B) doesn’t cover, such as copayments, coinsurance, and deductibles. There are several standardized Medigap plans labeled A through N, each offering different levels of coverage.

What is Medicare Plan M?

Definition

So, what exactly is Medicare Plan M? Medicare Plan M is one of the Medigap plans. It helps cover some of the costs that Original Medicare doesn’t, but it does so in a unique way. Unlike some other Medigap plans, Plan M covers only 50% of the Part A deductible, but it fully covers Part B coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

Eligibility

To be eligible for Medicare Plan M, you must first be enrolled in Medicare Parts A and B. Most people qualify for Medicare when they turn 65. You can enroll during your Medigap Open Enrollment Period, which is the six-month period that starts the month you turn 65 and are enrolled in Part B.

Key Features of Medicare Plan M

Coverage Details

Medicare Plan M is designed to help with several key expenses. Here’s a breakdown of what it covers:

-

-

-

-

- Hospital Costs: Covers Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

- Part A Deductible: Covers 50% of the Part A deductible.

- Part B Coinsurance: Covers 100% of the Part B coinsurance.

- Blood: Covers the first three pints of blood needed in a medical procedure.

- Skilled Nursing Facility Care: Covers Part A coinsurance for skilled nursing facility care.

- Foreign Travel Emergency: Provides coverage for emergency care during the first 60 days of a trip outside the U.S.

-

-

-

Cost Sharing

One of the unique aspects of Medicare Plan M is its cost-sharing feature. Plan M covers only 50% of the Medicare Part A deductible. This means that if you have a hospital stay, you will be responsible for half of the Part A deductible, while Medicare Plan M takes care of the other half. On the other hand, it covers 100% of the Part B coinsurance, which is the portion you pay after meeting your Part B deductible.

Notes

- ✓ = 100% coverage

- ✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted)

Benefits of Medicare Plan M

Financial Protection

Medicare Plan M can provide significant financial protection, especially if you have frequent hospital visits. By covering a portion of your deductibles and coinsurance, it helps manage out-of-pocket costs

Flexibility

One of the biggest advantages of Medigap plans, including Medicare Plan M, is the flexibility they offer. With Plan M, you have the freedom to choose any doctor or hospital that accepts Medicare. This means you don’t have to worry about staying within a network or getting referrals to see specialists. It’s perfect for those who travel frequently or live in areas with limited healthcare options.

Comparing Medicare Plan M with Other Medigap Plans

Plan M vs. Plan N

You might be wondering how Medicare Plan M stacks up against other Medigap plans. Let’s start with Plan N. Both Plan M and Plan N offer cost-sharing features, but they do so differently. Plan N has lower premiums but requires you to pay copayments for some doctor visits and emergency room visits. Medicare Plan M, on the other hand, has a more straightforward cost-sharing approach with the 50% Part A deductible coverage and no additional copayments for doctor visits.

Plan M vs. Plan G

Plan G is one of the most comprehensive Medigap plans, covering almost everything except the Part B deductible. While Plan G provides extensive coverage, it comes with higher premiums. Medicare Plan M might be a better option if you’re looking for a balance between coverage and cost, as it offers significant benefits with a lower premium.

Plan M vs. Medicare Advantage

It’s also important to compare Medicare Plan M with Medicare Advantage (Part C). Medicare Advantage plans are an alternative to Original Medicare and often include additional benefits like dental, vision, and prescription drug coverage. However, they typically have network restrictions and may require referrals to see specialists. Medicare Plan M, as a Medigap plan, supplements Original Medicare and offers the flexibility to see any doctor that accepts Medicare, making it a good choice for those who value freedom in choosing healthcare providers.

Enrollment Process

How to Enroll

Enrolling in Medicare Plan M is relatively straightforward. Here’s a step-by-step guide:

- Enroll in Medicare Parts A and B: You need to be enrolled in both Medicare Parts A and B before you can sign up for a Medigap plan.

- Apply for Plan M: Contact the insurance representative who can offer Medicare Plan M in your state and complete the application process.

- Review and Sign: Make sure you review the policy details and understand the coverage before signing.

Tips for Choosing the Right Plan

Choosing the right Medigap plan can be overwhelming, but here are a few tips to help you make the best decision:

- Assess Your Health Needs: Consider your current health status and any anticipated medical needs.

- Budget: Evaluate how much you can afford to spend on premiums and out-of-pocket costs.

- Compare Plans: Look at the different Medigap plans available and compare their benefits and costs.

- Seek Advice: Don’t hesitate to reach out to a Medicare insurance agent for personalized guidance.

Frequently Asked Questions (FAQs)

Does Plan M cover prescription drugs?

No, Medicare Plan M does not cover prescription drugs. You’ll need to enroll in a separate Medicare Part D plan for prescription drug coverage.

Can I switch from another Medigap plan to Plan M?

Yes, you can switch to Medicare Plan M, but you may be subject to medical underwriting unless qualify for a special enrollment period.

What happens if I travel outside the U.S.?

Medicare Plan M provides coverage for emergency medical care on a trip outside the U.S., which can be a lifesaver if you’re a frequent traveler.

Conclusion

Medicare Plan M is a great option for those looking for a balance between coverage and cost. It helps cover some of the out-of-pocket expenses that Original Medicare doesn’t, such as the Part A deductible (at 50%) and Part B coinsurance (at 100%).

For more personalized advice, feel free to contact 411Medicare. We’re here to help you navigate the maze of Medicare and find the plan that’s best for you.

Key Details Summarized

Plan M provides reduced monthly premiums in return for slightly lower benefits compared to certain other supplementary plans.

Plan M is offered less frequently compared to other plans.

Plan M can be a suitable option for individuals seeking to reduce premium costs while also building a substantial savings fund.