Medigap Plan N

Essential Highlights

Medigap Plan N is highly favored among Medicare beneficiaries.

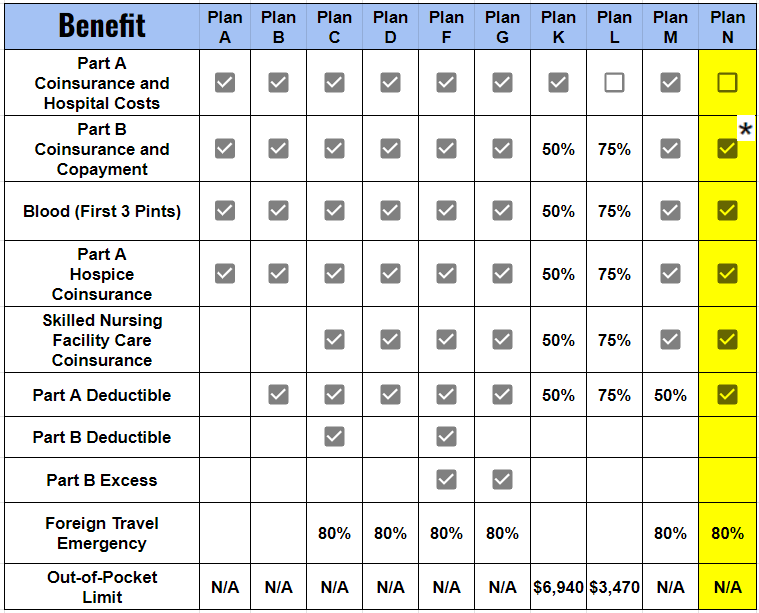

Plan N covers all Medicare gaps except for the Part B deductible, Part B excess charges, and minor copayments for office and emergency room visits.

Plan N typically features lower premiums than Plan G, but it comes with slightly higher out-of-pocket costs.

Medigap Plan N

Think of Medicare as a safety net that helps cover healthcare costs as you age. However, it doesn’t cover everything, which is where Medicare Supplement Plans, also known as Medigap, come in. One specific Medigap plan is called Medigap Plan N.

What is Medigap Plan N?

So, what exactly is Medigap Plan N? In simple terms, it’s a type of Medigap policy designed to fill some of the gaps left by Original Medicare (Parts A and B). Medigap Plan N are the add-ons that enhance your coverage, making your healthcare journey smoother and less costly.

Benefits of Medigap Plan N

Medigap Plan N offers a robust set of coverages that can really help reduce your out-of-pocket expenses. Here’s a breakdown of what you get:

Hospital and Hospice Care

Medigap Plan N covers the Part A coinsurance and hospital costs for up to an additional 365 days after you’ve used up your Medicare benefits. This is a huge relief if you ever face a long hospital stay. Plus, it covers Part A hospice care coinsurance or copayment, ensuring that you receive compassionate care without the stress of high costs.

Blood and Skilled Nursing Facility Care

If you need blood for a medical procedure, Medigap Plan N covers the first three pints each year. It also pays for the coinsurance costs associated with skilled nursing facility care, which can be a significant expense if you require rehabilitation or extended care.

Foreign Travel Emergency

Medigap Plan N is the foreign travel emergency coverage. It covers 80% of emergency healthcare costs when you’re outside the U.S., up to the plan limits.

✓ = 100% coverage

✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted)

Costs Associated with Medigap Plan N

While Medigap Plan N is generally more affordable in terms of premiums compared to some other Medigap plans, there are some out-of-pocket costs you should be aware of.

Premiums and Copayments

You’ll pay a monthly premium for Medigap Plan N, which varies depending on factors like your age and location. On top of that, you’ll have small copayments for office visits (up to $20) and emergency room visits (up to $50).

Balance Billing

One important thing to note about Medigap Plan N is the potential for balance billing. This happens when a healthcare provider charges more than the Medicare-approved amount. While this is relatively rare, it’s something to keep in mind. However, many states have laws to limit balance billing, so it’s worth checking the rules in your state.

Comparing Plan N with Other Medigap Plans

You might be wondering how Medigap Plan N stacks up against other Medigap plans. Let’s take a quick look at a couple of popular options.

Plan N vs. Plan G

Plan G is another well-liked Medigap plan. The main difference is that Plan G covers the Part B deductible, while Medigap Plan N does not. This means you might pay slightly more out-of-pocket with Plan N, but the premiums are usually lower, which can balance things out.

Plan N vs. Plan F

Plan F is the most comprehensive Medigap plan, covering all deductibles and coinsurance. However, it’s also the most expensive and no longer available to new Medicare beneficiaries as of 2020. If you already have Plan F, it might be worth comparing its costs with Medigap Plan N to see if switching makes sense for you.

Eligibility and Enrollment

So who can sign up for Medigap Plan N? If you’re eligible for Medicare, you can apply for a Medigap plan. The best time to enroll is during your Medigap Open Enrollment Period, which starts the first month you have Medicare Part B and are 65 or older. During this period, you have guaranteed issue rights, meaning you can get any Medigap policy sold in your state without medical underwriting. Outside of your open enrollment, you can apply with Medical Underwriting or if you qualify from one of the many Special Enrollment periods such as leaving employer coverage.

Tips for Applying

When applying, consider factors like your current health, budget, and future healthcare needs. It’s a good idea to consult with an insurance representative who can help you compare plans and find the best fit.

Frequently Asked Questions

What is the difference between Medicare Advantage and Medigap Plan N?

Medicare Advantage plans are an alternative to Original Medicare, offered by private companies. They often include additional benefits like dental and vision but come with network restrictions. Medigap plans, like Medigap Plan N, supplement Original Medicare and provide more predictable out-of-pocket costs without network restrictions.

Can I switch from another Medigap plan to Plan N?

Yes, you can switch from another Medigap plan to Medigap Plan N. However, you might need to go through medical underwriting or qualify for a Special Election Period.

Will my Plan N coverage work when I travel?

Yes, Medigap Plan N covers you for emergency medical care during foreign travel, up to plan limits. It’s a great feature for those who love to travel or spend time abroad.

Conclusion

Medigap Plan N is a solid choice for many seniors looking to manage their healthcare costs effectively. It offers comprehensive coverage for many of the gaps left by Original Medicare, with lower premiums than some other Medigap plans. Whether you’re planning a trip around the world or just want peace of mind about your healthcare expenses, Medigap Plan N can provide the security you need.

Key Details Summarized

All carriers offering Medigap Plan N must provide identical coverage, although the premium may vary among carriers.

You may have copays of up to $20 for office visits and up to $50 for ER visits after meeting the Part B deductible.

Plan N could be a more cost-effective option compared to Plan G if you rarely visit the doctor.