Medicare Part A

Essential Highlights

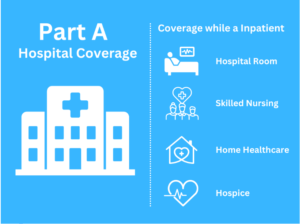

Medicare Part A offers coverage for inpatient hospital services, skilled nursing facility care, and hospice care.

Medicare Part A typically does not require a monthly fee for individuals who have worked in the United States for at least 10 years and contributed to payroll taxes.

Medicare Part A generally covers most of the expenses associated with Part A services, although you will still need to cover the deductible and coinsurance fees.

What Does Medicare Part A Cover?

Overview of Medicare Part A

Medicare Part A is your hospital insurance. It covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. Think of it as your safety net when you need more serious medical attention. For example, if you’re admitted to the hospital for surgery or need rehabilitation after an injury, Part A steps in to help cover those costs.

Services Covered Under Medicare Part A

To give you a better idea, here’s a breakdown of the services covered under Medicare Part A:

- Inpatient Hospital Stays: This includes semi-private rooms, meals, general nursing, and drugs as part of your inpatient treatment.

- Skilled Nursing Facility Care: After a qualifying hospital stay, Part A helps cover a limited stay in a skilled nursing facility.

- Hospice Care: For those with a terminal illness, Part A covers hospice care, focusing on comfort rather than cure.

- Home Health Care: Limited to part-time or intermittent skilled nursing care and therapy.

Eligibility for Medicare Part A

Who Qualifies?

Generally, you qualify for Medicare Part A if you’re 65 or older. But there are a few exceptions. If you’re under 65 and have certain disabilities, or if you have End-Stage Renal Disease (ESRD) or ALS (Lou Gehrig’s disease), you might also be eligible.

Work History Requirements

Your eligibility for premium-free Medicare Part A depends largely on your work history. If you or your spouse worked and paid Medicare taxes for at least 10 years (40 quarters), you typically qualify for premium-free Part A. This is one of the most common routes to eligibility.

Cost of Medicare Part A

Premium-Free Medicare Part A

The best news? Many people get Medicare Part A without paying a premium. If you or your spouse paid Medicare taxes for at least 10 years (that’s 40 quarters), you’re eligible for premium-free Medicare Part A. This is a huge relief for many, as it means one less bill to worry about in retirement.

Premium-Based Medicare Part A

If you don’t meet the 40 quarters requirement, don’t panic. You can still get Medicare Part A, but you’ll have to pay a monthly premium. In 2024, the premiums are:

- $506 per month if you paid Medicare taxes for less than 30 quarters.

- $278 per month if you paid Medicare taxes for 30-39 quarters.

Other Costs Associated with Medicare Part A

Deductibles

Even with premium-free Medicare Part A, there are still some costs to consider, like deductibles. In 2024, the inpatient hospital deductible is $1,632 per benefit period. This means if you’re admitted to the hospital, you’ll need to pay this amount before Medicare Part A kicks in.

Coinsurance

Once you’ve paid the deductible, there’s coinsurance. For hospital stays:

- Days 1-60: $0 coinsurance per day.

- Days 61-90: $408 per day.

- Beyond 90 days: $816 per each “lifetime reserve day” (you get up to 60 of these).

Skilled Nursing Facility Care Coinsurance

For skilled nursing facility care:

- Days 1-20: $0 coinsurance per day.

- Days 21-100: $204 per day.

A client named Jane had a long hospital stay after a complicated surgery. The coinsurance added up, but knowing these numbers upfront helped her and her family plan better for the expenses.

Additional Costs for Specific Services

It’s also important to note that not all services are fully covered. For example:

- Blood: If the hospital has to buy blood for you, you’ll pay for the first three units in a calendar year.

- Home Health Care: While Part A covers limited home health care, if you need extensive or long-term care, those costs can add up and may not be fully covered.

Financial Assistance and Additional Help

Medicare Savings Programs

If these costs sound daunting, don’t worry—there’s help available. Medicare Savings Programs assist with premiums, deductibles, and coinsurance for those who qualify. Eligibility is based on your income and resources. Programs include:

- Qualified Medicare Beneficiary (QMB) Program: Helps pay Part A and Part B premiums, deductibles, coinsurance, and copayments.

- Specified Low-Income Medicare Beneficiary (SLMB) Program: Helps pay Part B premiums.

- Qualifying Individual (QI) Program: Also helps pay Part B premiums, but funding is limited.

Medicaid and Dual Eligibility

If your income is very low, you might also qualify for Medicaid, which can cover many of your Medicare costs. Being dual-eligible means you have both Medicare and Medicaid, offering significant financial relief. This can be a game-changer for managing out-of-pocket expenses.

How to Enroll in Medicare Part A

You may be automatically enrolled in Medicare Part A when you turn 65 depending on your specific circumstances:

Automatic Enrollment: If you are already receiving benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65, you will be automatically enrolled in Medicare Part A (and Part B). You will receive your Medicare card in the mail about three months before your 65th birthday.

Manual Enrollment: If you are not receiving Social Security or Railroad Retirement benefits (for instance, if you are still working and have not yet applied for retirement benefits), you will not be automatically enrolled. In this case, you need to sign up for Medicare Part A (and Part B) during one of the enrollment periods.

Initial Enrollment Period (IEP)

You can sign up for Medicare Part A during your Initial Enrollment Period, which starts three months before you turn 65 and lasts for seven months. It’s best to enroll as soon as you’re eligible to avoid any gaps in coverage.

General Enrollment Period (GEP)

If you miss your IEP, you can sign up during the General Enrollment Period from January 1 to March 31 each year. Just remember, enrolling late might mean paying a higher premium.

Special Enrollment Periods (SEP)

Special Enrollment Periods are available for those who qualify due to certain life events, like losing employer coverage. For instance, if you’re 67 and retire, losing your job-based insurance, you can enroll in Medicare Part A without a late penalty.

Common Questions and Concerns

Addressing Myths

There are a lot of myths out there about Medicare Part A. One common one is that it covers everything, but as we’ve seen, there are still out-of-pocket costs. Another myth is that you’ll be automatically enrolled, which isn’t always the case, especially if you’re not yet receiving Social Security benefits.

Clarifying Misconceptions

It’s also important to understand that Medicare Part A doesn’t cover long-term care or custodial care if that’s the only care you need. This is a common misunderstanding and can lead to unexpected expenses down the road.

Tips for Managing Expenses

To manage your healthcare expenses, consider setting aside a small emergency fund specifically for medical costs. Also, explore supplemental insurance options like Medigap, which can help cover some of those out-of-pocket expenses. Another option is to look into Medicare Advantage Plans (Part C), which often include additional benefits not covered by Original Medicare.

Conclusion

Understanding Medicare Part A can seem overwhelming, but breaking it down step by step makes it more manageable. Remember, there are resources and people ready to help you navigate this journey. Don’t hesitate to reach out to a 411Medicare insurance representative for personalized advice. And remember, you’re not alone—many seniors are going through the same process.