What is a Medicare Supplement?

Essential Highlights

Medicare Supplement (Medigap) plans serve as supplementary insurance to Original Medicare, with Medicare covering initial costs followed by your Medigap plan covering subsequent expenses.

A Medigap plan assists in paying for your share of expenses when using Medicare, such as deductibles, copayments, and coinsurance.

Medigap plans are provided by private insurance companies, rather than by the federal government.

What is a Medicare Supplement?

If you’re here, you’re probably trying to understand what a Medicare Supplement is all about. Whether you’re new to Medicare or just trying to make sense of all the options, you’ve come to the right place. Let’s dive in and make this as simple and clear as possible.

Understanding the Basics

What is Medicare?

First, let’s start with the basics. Medicare is a federal health insurance program primarily for people aged 65 and older, although it also covers some younger individuals with disabilities. Medicare is divided into four parts:

- Part A (Hospital Insurance): This helps cover inpatient care in hospitals, skilled nursing facilities, hospice, and home health care.

- Part B (Medical Insurance): This covers services like doctors’ visits, outpatient care, medical supplies, and preventive services.

- Part C (Medicare Advantage): These are Medicare-approved plans from private companies that offer an alternative to Original Medicare for your health and drug coverage.

- Part D (Prescription Drug Coverage): This helps cover the cost of prescription drugs.

Gaps in Original Medicare Coverage

While Medicare Parts A and B cover many healthcare costs, they don’t cover everything. There are out-of-pocket expenses like copayments, coinsurance, and deductibles that can add up quickly. Many people become shocked when they receive a hospital bill after a minor surgery. There a misconception Medicare would cover everything, but but many end up with a sizable bill because of these gaps. This is where a Medicare Supplement comes in.

Introduction to Medicare Supplement Insurance

What is a Medicare Supplement Insurance (Medigap)?

Medicare Supplement Insurance, often called Medigap, is designed to fill the “gaps” left by Original Medicare. These policies are sold by private insurance companies and help pay some of the healthcare costs that Original Medicare doesn’t cover.

.

How a Medicare Supplement Works

Medicare Supplement policies work alongside your Original Medicare coverage. When you receive healthcare services, Medicare pays its share of the approved amount, and then your Medigap policy pays its share. It’s important to note that Medigap is different from Medicare Advantage (Part C). Medigap supplements your Original Medicare benefits, while Medicare Advantage is an alternative way to get your Medicare benefits.

Medigap Plans

Standardized Medigap Plans

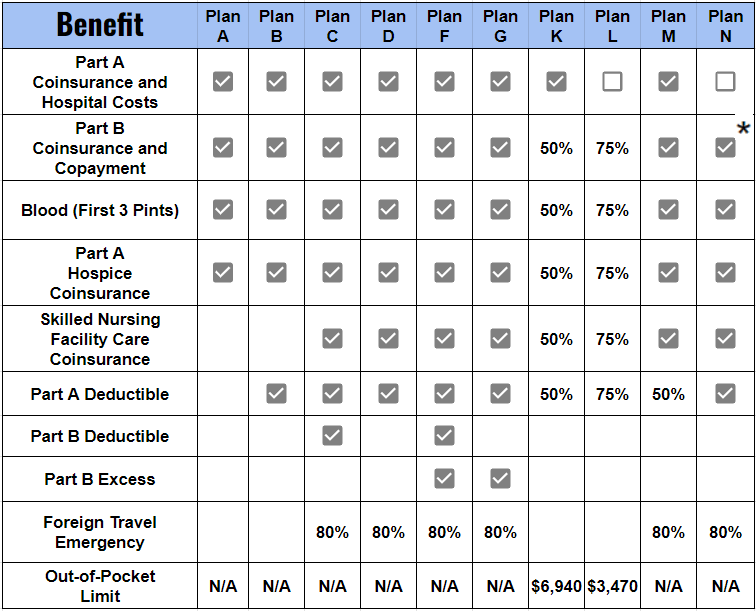

Medicare Supplement plans are standardized, which means they offer the same basic benefits regardless of which insurance company sells them. These plans are labeled by letters (A through N), and each lettered plan offers a different set of benefits.

For example, Plan F, one of the most comprehensive plans, covers almost all out-of-pocket costs, including Part A and Part B deductibles, copayments, and coinsurance. On the other hand, Plan A offers the most basic coverage, focusing on Part A hospital coinsurance and an additional 365 days of hospital coverage after Medicare benefits are used up.

✓ = 100% coverage

✓* = Copay up to $20 office visit and up to $50 for an Emergency Room Visit ( Not Admitted)

Choosing the Right Plan

Choosing the right Medicare Supplement plan depends on your healthcare needs and budget. The best way to choose is to review your healthcare needs, your budget, and how much you are comfortable paying out-of-pocket. The time you take to answer these questions will be well worth it to find the plan that best fits your needs.

Eligibility and Enrollment

Eligibility Requirements

To be eligible for a Medicare Supplement policy, you must already have Medicare Part A and Part B. The best time to buy a Medicare Supplement policy is during your six-month Medigap Open Enrollment Period, which starts the month you turn 65 and are enrolled in Part B. During this period, you have a guaranteed right to buy any Medigap policy sold in your state, regardless of your health status.

Outside of the Medigap Open Enrollment Period, you can still qualify for a Medicare Supplement Plan through several alternative routes.

- One common method is through a Special Enrollment Period (SEP), which you may qualify for if you experience certain life events, such as losing other health coverage, moving to a new area where different plans are available, or losing eligibility for Medicaid. Additionally, some states have specific regulations that provide guaranteed issue rights, allowing you to purchase a Medigap policy without medical underwriting under certain conditions.

- You can also choose to go through underwriting. Underwriting involves completing a detailed health questionnaire and providing consent to your medical records. The insurance company will review your medical history and current health status to assess the risk of insuring you. It is a viable option for obtaining a Medigap policy if you missed your initial enrollment period and are in good health.

Enrollment Process

The enrollment process for a Medicare Supplement policy is straightforward. First, you need to compare the different plans and insurance companies to find the one that best meets your needs. Once you’ve selected a plan, you can contact a representative at 411Medicare to apply.

Costs and Savings

Cost of Medicare Supplement Policies

The cost of Medicare Supplement policies varies depending on several factors, including your age, gender, location, and the specific plan you choose. Premiums for Medicare Supplement policies can range widely, so it’s essential to shop around and compare prices from different insurance companies.

Potential Savings

Medicare Supplement policies can save you money in the long run by covering many of the out-of-pocket costs that Original Medicare doesn’t. For instance, we had a client who needed frequent doctor visits and hospital stays. Her Medigap Plan G policy covered most of her out-of-pocket expenses, saving her thousands of dollars each year.

Additional Considerations

Medigap vs. Medicare Advantage

One common question is how Medigap differs from Medicare Advantage. Medicare Advantage plans are an alternative way to get your Medicare benefits through private insurance companies. These plans often include additional benefits, like vision, dental, and prescription drug coverage.

However, with Medicare Advantage, you typically have to use the plan’s network of doctors and hospitals. On the other hand, a Medicare Supplement policy allows you to see any doctor who accepts Medicare. This flexibility was a significant factor for many seniors who have several specialists they want to continue seeing.

How to Switch Medicare Supplement Policies

If you want to switch Medicare Supplement policies, you can do so, but there are specific rules. If you’re outside your Medigap Open Enrollment Period, you might have to go through medical underwriting, which means the insurance company can consider your health status when deciding whether to sell you a policy.

However, there are some situations, like if you move out of your plan’s service area or your insurer goes bankrupt, where you have guaranteed issue rights and can switch policies without medical underwriting.

Conclusion

We’ve discussed what a Medicare Supplement is, the gaps in coverage, and how Medigap policies can help fill those gaps. We’ve also looked at the different Medigap plans, eligibility requirements, costs, and how to choose the right plan.

For more information, you can contact a licensed insurance agent at 411Medicare who specializes in Medicare Supplement policies. It’s always a good idea to review your healthcare needs regularly and explore your options to ensure you have the coverage that best meets your needs.